Over the years, we’ve created a few simple tools to help people improve their financial situation and avoid common mistakes. These are optional resources I personally created and stand behind.

SurfSideSafe is a larger project I’ve been building alongside CharlesMoney — a people-first social platform focused on privacy, creativity, and real connection. While CharlesMoney focuses on financial clarity, SurfSideSafe represents the bigger picture of building something meaningful and independent on the web.

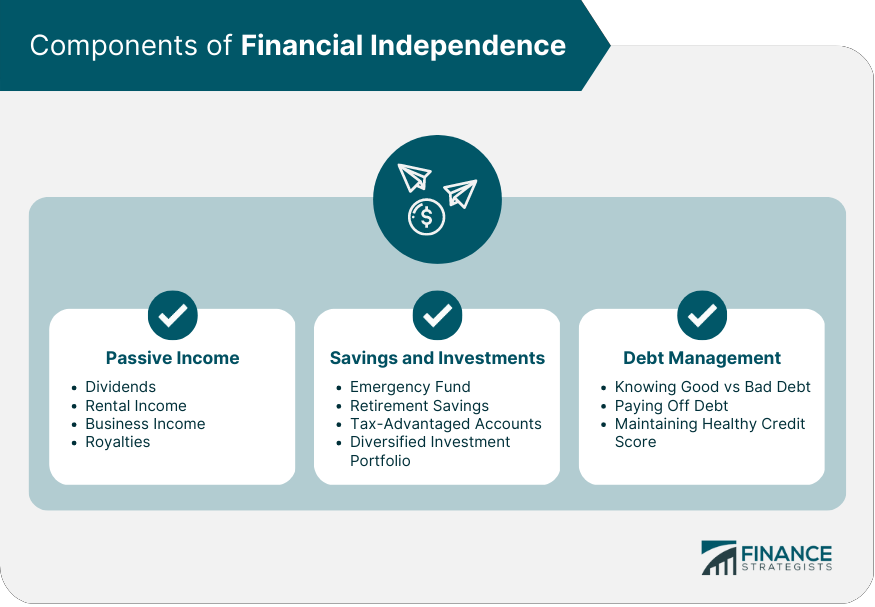

Financial independence is a goal that many people strive for. It can provide a sense of security, freedom and peace of mind.

Exactly what does it mean to be financially independent, and how can you achieve it?

In this article, we will explore the benefits of financial independence and provide tips for reaching this important milestone.

Financial independence means different things to different people.

For some people, it can mean having enough money saved to retire early and live comfortably, without relying on a traditional job.

For others, it may mean having enough passive income to cover all expenses and not having to work at all.

Take some time to define what financial independence means to you and what your specific goals are. This will help you create a plan and stay motivated as you work towards achieving your financial goals.

A budget is an essential tool for reaching your financial independence goal.

You will need to estimate how much you spend each month and track all of your income sources. Your budget should then reflect both the money that comes in and goes out each month.

To stay on track, come up with a strategy or plan for saving money and stick to it. Set a specific amount of money to save each month, consider reducing expenses that are nonessential, and make sure to pay down your debt as soon as possible.

Taking control of your finances and understanding where your money is going can help you reach financial freedom faster.

One of the biggest obstacles to achieving financial independence is debt. High-interest debt, such as credit card debt, can quickly accumulate and make it difficult to save money or invest in your future.

To reach financial independence, it’s important to pay off your debt as soon as possible and avoid taking on new debt. Consider creating a debt repayment plan, such as the snowball or avalanche method, to prioritize paying off your debts.

Additionally, try to avoid taking on new debt by living within your means and only making purchases that you can afford to pay off in full.

Building an emergency fund is a crucial step towards achieving financial independence.

This fund should ideally cover at least three to six months of your living expenses, and should be kept in a separate savings account that is easily accessible in case of an emergency.

Having an emergency fund can provide you with peace of mind and financial security, as unexpected expenses such as medical bills or car repairs can quickly derail your financial goals if you don't have the funds to cover them.

Start small by setting aside a portion of your income each month and gradually increasing the amount until you reach your goal.

Investing is a key component of achieving financial independence.

By investing your money wisely, you can grow your wealth and secure your financial future.

There are many different types of investments to consider, including stocks, bonds, mutual funds, and real estate.

It's important to do your research and consult with a financial advisor before making any investment decisions.

Start by setting aside a portion of your income each month for investing, and gradually increase the amount as you become more comfortable with the process. Remember, investing is a long-term strategy, so be patient and stay focused on your goals.

Remember this:

When you practice being better at managing your money, you practice being better at managing your life.

I hope this article has helped you.

AND:

Remember! At CharlesMoney, we are here to help you succeed.

Images courtesy of Creative Commons.